Introduction

Managing cash flow efficiently is crucial for any business, big or small. Among the various tools and methods used to manage day-to-day expenses, Petty Cash Book and Imprest System stand out as popular options. While both are aimed at handling minor expenses, they differ in structure, purpose, and execution. Let’s dive deeper into what these systems are and how they differ.

What is a Petty Cash Book?

A Petty Cash Book is a ledger used to record small, recurring expenses such as office supplies, travel expenses, or refreshments. It functions as a manual record for tracking cash transactions that do not require issuing cheques or making bank transfers.

Features of a Petty Cash Book:

- Small Transactions: Primarily used for day-to-day minor expenses.

- Convenience: Eliminates the need for complex accounting for small payments.

- Manual Record-Keeping: Entries are typically recorded by a designated petty cashier.

- Decentralised Control: Each department or branch can maintain its petty cash book for local expenses.

What is the Imprest System?

The Imprest System is a controlled way of managing petty cash by maintaining a fixed amount. The petty cashier is given a specific sum, called an imprest amount, at the beginning of a period. At the end of the period, they submit an expense report, and the fund is replenished to the original amount.

Features of the Imprest System:

- Fixed Float: A predefined amount is allocated for petty cash.

- Accountability: The petty cashier must justify all expenses with receipts and records.

- Replenishment: Funds are topped up only after verifying the expense report.

- Centralised Control: Ensures a clear audit trail for small expenditures.

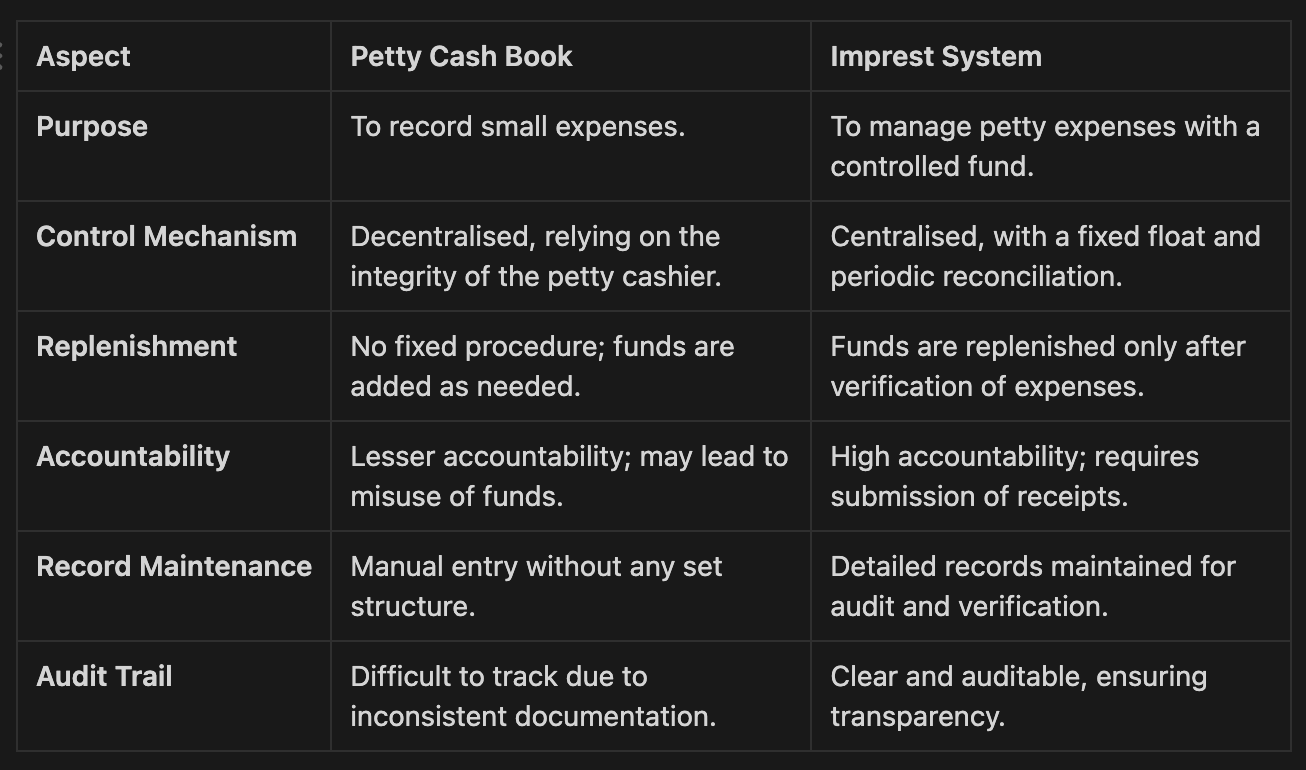

Key Differences Between Petty Cash Book and Imprest System

Which System is Best for Your Business?

The choice between a Petty Cash Book and an Imprest System depends on your business needs:

- For small, informal businesses: A Petty Cash Book might suffice due to its simplicity and flexibility.

- For structured, growth-oriented businesses: The Imprest System is ideal as it ensures better control, transparency, and accountability.

At CashBook, we understand the challenges of managing small business expenses. Our digital tools make tracking and managing expenses seamless, whether you're using a Petty Cash Book, an Imprest System, or both. With integrated UPI wallets and real-time tracking, CashBook simplifies your financial management so you can focus on growing your business.

Conclusion

Understanding the differences between a Petty Cash Book and an Imprest System can help you choose the right approach for managing minor expenses effectively. While both have their advantages, the Imprest System stands out for businesses that prioritise accountability and control.

Ready to take your expense management to the next level? Explore how CashBook can help you.

Would you like assistance in implementing these systems in your business? Contact us today!